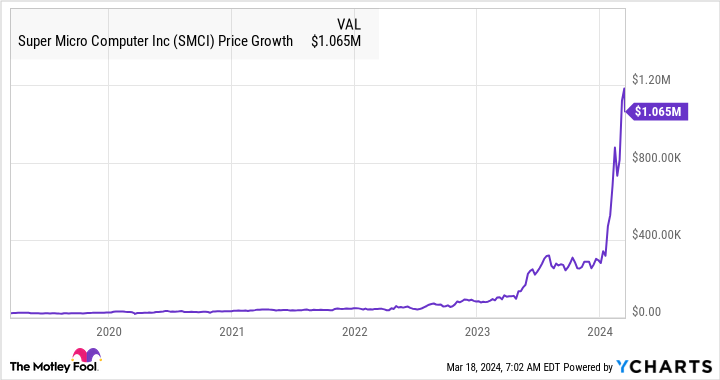

Super Micro Computer (NASDAQ: SMCI) has been one of the hottest stocks on the market in 2024 with astounding gains of almost 300%, but investors who have been holding shares of this server manufacturer for a longer period are now sitting on much stronger gains.

For example, a $20,000 investment in Supermicro stock five years ago is now worth more than $1 million.

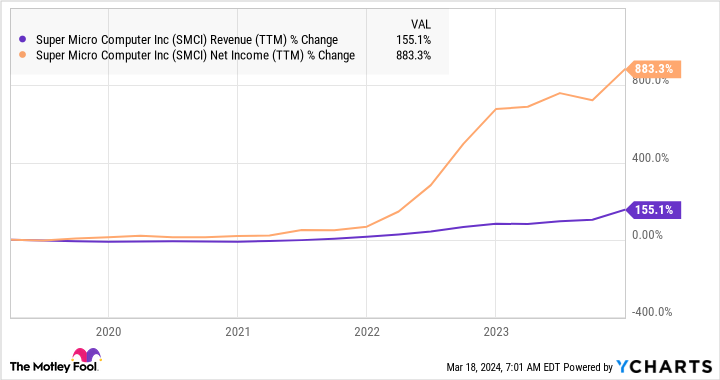

Supermicro stock has been handsomely rewarded for its outstanding growth in recent years, which has been driven by the secular growth of the server market.

SMCI Revenue (TTM) data by YCharts

Now, historical performance isn’t necessarily an indicator of a stock’s future performance. So, there is no guarantee that Supermicro could turn a $20,000 investment into a million once again over the next five years. However, investors looking to construct a diversified million-dollar portfolio would do well to buy shares of Supermicro. Let’s look at the reasons why.

Supermicro is gaining share in a fast-growing market

The proliferation of artificial intelligence (AI) has given the server market a big boost. According to market research firm TrendForce, the AI server market recorded 38% growth in 2023, and it is expected to clock annual growth of more than 20% through 2026. Another assessment from Global Market Insights (GMI) estimates that the AI server market generated $38 billion in revenue in 2023, a figure that’s expected to jump to $177 billion in 2032.

Supermicro has generated $9.25 billion in revenue in the trailing 12 months. Management pointed out on the company’s January earnings conference call that AI-related server sales account for more than 50% of its total revenue. So, we can assume that the company sold around $4.6 billion worth of AI servers in 2023. That places Supermicro’s share of the AI server market at 12%, based on the market’s size in 2023 as per Global Market Insights.

The good part is that Supermicro is growing at a faster pace than the AI server market, suggesting that it is gaining a bigger share of this space. For example, the company’s revenue in the second quarter of fiscal 2024 (for the three months ended Dec. 31, 2023) shot up to $3.66 billion from $1.8 billion in the year-ago period.

For the first six months of fiscal 2024, Supermicro’s revenue has increased an impressive 58% year over year to $5.78 billion. Even better, the company’s outlook for the second half is stronger as it expects fiscal 2024 revenue to land at $14.5 billion at the midpoint of its guidance range. That would translate into a year-over-year jump of 104% from fiscal 2023’s revenue of $7.1 billion.

Analysts are forecasting Supermicro’s revenue to increase 39% in the next fiscal year to just over $20 billion. However, the company could easily go past that mark, as its new manufacturing facilities have taken its “annual revenue capacity above $25 billion,” as management pointed out on the previous earnings conference call.

Given the lucrative growth opportunity present in the AI server market, Supermicro’s focus on capacity expansion should eventually allow it to capture a bigger share of this space in the long run. That should ideally lead to solid growth in the company’s top and bottom lines and help Super Micro stock deliver robust gains over the next decade.

How much upside can investors expect in the long run?

As noted, Supermicro controls just over 12% of the AI server market. However, it won’t be surprising to see its market share rise rapidly in the future considering the company’s focus on capacity expansion. If Supermicro does generate $20 billion in revenue in the next fiscal year, its share of the AI server market would stand at 38% (based on GMI’s estimate that the AI server market is growing at 18% annually and was worth $38 billion in 2023, the size of the market should be $53 billion in 2025).

Assuming Supermicro can maintain even a 35% share of the server market in 2032, its top line could jump to $62 billion in less than a decade. Supermicro is currently trading at 7 times sales, which is almost in line with the U.S. technology sector’s average price-to-sales ratio of 7.2.

If Supermicro maintains its current sales multiple in 2032 and generates $62 billion in revenue at that time, its market cap could jump to $434 billion. That would be seven times its current market cap, indicating that it can turn $20,000 into more than $140,000. However, it is worth noting that Supermicro is substantially cheaper than other AI stocks. So, it won’t be surprising to see the market reward it with a higher sales multiple in the future, and that could lead to even stronger gains.

So, Supermicro may or may not turn $20,000 into a million dollars once again, but it is clear that investing in this AI stock could help investors achieve their quest of becoming millionaires thanks to its impressive growth and the secular growth opportunity it is sitting on in the form of the AI server market.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 21, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

1 Artificial Intelligence (AI) Stock That Has Created Millionaires and Will Continue to Make More was originally published by The Motley Fool