Naming the single best artificial intelligence (AI) stock to buy right now is no easy task. There are many considerations: what the company could do, what it’s doing now, how expensive the stock is, and whether it has room to expand. All of these factors weigh into determining the best AI stock right now.

I think I’ve found the candidate with the perfect combination: Taiwan Semiconductor Manufacturing (NYSE: TSM). It’s one of the few companies I know that excels in all of the factors I mentioned above, which makes a compelling investment case for the stock.

2024 has been an excellent year for TSMC

Taiwan Semiconductor — also known as TSMC — is the world’s largest contract chip manufacturing company. Essentially, customers come to it with a chip design and TSMC produces it for them. Apple iPhones wouldn’t be the same without TSMC, and Nvidia GPUs wouldn’t be creating incredible AI models.

With the rising demand for AI chips, TSMC’s 2024 monthly revenue has far exceeded that of 2023. Granted, 2023 was a relatively weak year for chip demand. However, continued outperformance month over month is a great sign that TSMC’s business is picking up.

|

Month |

Revenue Growth (YoY) |

|---|---|

|

January |

7.9% |

|

February |

11.3% |

|

March |

34.3% |

|

April |

59.6% |

|

May |

30.1% |

|

June |

32.9% |

|

July |

44.7% |

|

August |

33% |

Data source: Taiwan Semiconductor. YoY = year over year.

Taiwan Semiconductor also has great tailwinds upcoming. Apple accounts for about 25% of its revenue in any given year, and it’s no secret that iPhone demand hasn’t been that high. With Apple’s AI model, Apple Intelligence, only available on iPhones 15 and newer models, this could ignite an upgrade cycle that will result in massive sales for TSMC.

TSMC is already developing the next generation of chips, even though its latest generation of 3-nanometer chips was just recently launched and is still growing in popularity. The 2nm chip can offer a 10% to 15% speed improvement over the 3nm chip when configured for the same power consumption, but offers 25% to 30% more power efficiency when configured at the same speed level.

When the operating costs for giant data centers are so high due to electricity alone, the improvements this chip generation can offer are incredible. They could ignite an upgrade cycle on their own based solely on long-term cost savings. Management is seeing higher interest for its 2nm chips than 3nm or 5nm chips at this development stage, which points to strong demand once it reaches production sometime in 2025.

Clearly, TSMC has a lot going for it on the business end, with plenty of room to expand and near-term tailwinds to push it higher in the meantime. But is the stock in a spot where it’s worth buying?

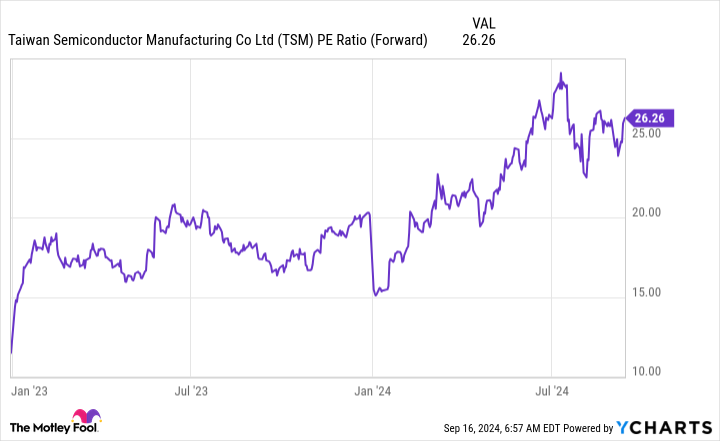

The stock isn’t that expensive compared to other market staples

The market knows all of the points listed above, so it has given TSMC a bit of a valuation premium. However, it’s not at nearly the same level as some other AI stocks and isn’t far off where the broader market (measured by the S&P 500) trades.

At 26 times forward earnings, TSMC isn’t the world’s cheapest stock. However, with the S&P 500 trading at around 22.7 times forward earnings, it doesn’t seem like that much of a premium to pay. It even seems quite reasonable compared to some more conservative, non-tech investments.

|

Company |

Forward P/E |

Latest Quarter Revenue Growth |

Dividend Yield |

|---|---|---|---|

|

Taiwan Semiconductor |

26.3 |

32.9% |

1.3% |

|

Coca-Cola |

25.0 |

3.2% |

2.7% |

|

Home Depot |

25.4 |

0.6% |

2.3% |

|

Walmart |

33.0 |

4.8% |

1% |

Data source: YCharts.

TSMC is growing much faster than these staples, has a respectable dividend, and can be bought for about the same price.

To me, Taiwan Semiconductor is about as much of a no-brainer buy as it gets, as the tailwinds blowing in its favor are massive. Couple that with a stock price that isn’t overvalued, and TSMC looks like a top AI investment.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $694,743!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Keithen Drury has positions in Home Depot and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Apple, Home Depot, Nvidia, Taiwan Semiconductor Manufacturing, and Walmart. The Motley Fool has a disclosure policy.

Opinion: This Is the Best Artificial Intelligence (AI) Stock to Buy Right Now was originally published by The Motley Fool