The Singapore FinTech Festival (SFF) has expanded over the years, evolving into a must-attend event for the global fintech community.

“There’s much buzz over the exhibitions and the number of talks, and people attending have also grown exponentially over the years. Many people choose the SFF to make announcements of new products or new initiatives.

“It’s very exciting with new business models being announced and founders coming up with new ideas. The entire community comes together,” said Monetary Authority of Singapore (MAS) managing director Chia Der Jiun in a wide-ranging interview ahead of the event. Apart from SFF, he also spoke on the challenges and issues that MAS faces as a regulator.

This year’s SFF to be held from Nov 6 to 8 sees movers and shakers from around the world – central bankers, regulators, industry leaders, entrepreneurs, investors, innovators and influencers – meet to explore, discuss and shape the trajectory of financial services and digital transformation.

The hot topics of artificial intelligence (AI), the rise of quantum computing, digital assets, next-generation transactions and sustainability are all set to feature on the agenda.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

SFF features various zones such as the Regulation Zone where representatives from central banks and other government organisations carry out discussions and knowledge sharing with industry professionals and others. The Technology Zone showcases advancements in the latest technologies and their practical applications, while those seeking mentorship and guidance can head over to the Talent Zone. The Founders and Investors Zone brings together startups and potential investors.

Even before this action starts, there’s the Insights Forum which is running from Nov 4 to 5 with some 300 speakers and 3,000 attendees. Topics of discussion include instant cross-border payments and ways that blockchains can be harnessed to fight financial crime and protect consumers.

Just to give some idea of the scale of the event, last year’s edition saw some 66,000 attendees and around 1,000 speakers converge on Singapore. This year’s ninth edition is expected to surpass these numbers.

MAS together with Global Finance & Technology Network (its formation was announced by MAS last week and replaces Elevandi), and Constellar are the organisers of SFF in collaboration with The Association of Banks in Singapore.

Payments and digital assets are among the drivers in the fintech space

Payments and payment solutions are among the growth drivers in the fintech space. There are many apps for cross-border payments and multicurrency cross-border payments, but this continues to be an area that is seeing fintech innovation.

An area that is seeing investment flows is the digital asset tokenisation space.

Yet another driver for the fintech growth space is private markets within the asset and wealth management segment. Singapore’s asset management and wealth sector has been growing at about a five-year compound annual growth rate of 10 per cent. Within that, the private markets segment is growing much faster at anything between 24 and 25 per cent.

Chia is confident that with the existing fintechs that are established here, founders who are based in Singapore and a vibrant venture capital community, “the dynamism continues, and new ideas will continue to be generated”.

Standardisation and industry collaboration for digital assets

Given such drivers of growth in the asset tokenisation space, MAS recognises that the adoption of a common set of standards and industry best practices reduces the incremental costs of deploying solutions, and facilitates the expansion of business opportunities.

Much effort has been devoted into developing this area; for example, MAS and key financial institutions piloted promising asset tokenisation use cases under Project Guardian. The partnership provided a platform for central banks, regulators and financial institutions to understand the opportunities and risks of asset tokenisation.

Workstreams have been set up to look at standards and frameworks across key asset classes such as fixed income, foreign exchange and asset and wealth management.

At the same time, regulators need to consider the appropriate infrastructure that would underpin this. To effectively scale tokenised markets globally, there is a need for a shared ledger infrastructure that can host multiple types of tokenised financial assets. It also has to meet relevant regulatory requirements while preserving the policy autonomy of participating jurisdictions.

Related to this is the debate over what constitutes the settlement asset. In the blockchain world, there are options such as tokenised deposits, tokenised commercial bank money or even stablecoins.

The expectation of stablecoins is that it is fully backed by safe assets and has redeemability features, liquidity features and reserve features; in sum, the value is stable.

Chia noted: “Singapore can make a contribution in this area, with a set of rules on what would make a good stablecoin.”

MAS plays an important role in the process. As Chia sees it, “we work with industry to reduce the barriers to enable players to move from Point A to Point B. It’s important to work within the industry consortium. When commercially, they say it makes sense, they are able to garner interest from their customers around it. We work with them to resolve pain points or problem barriers.”

Artificial intelligence

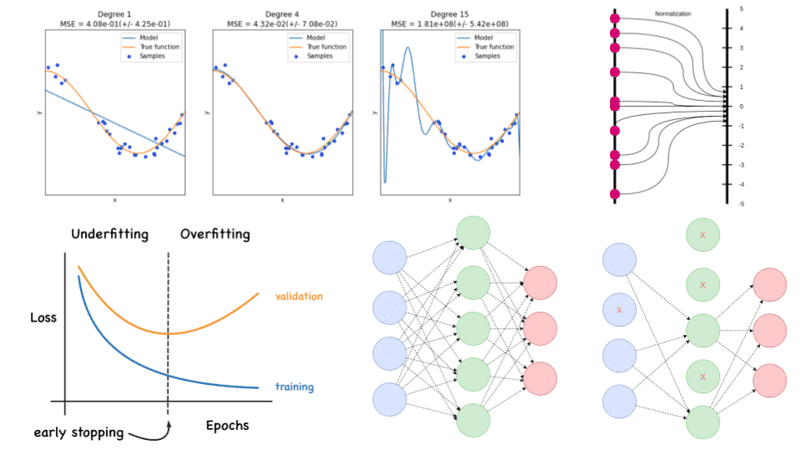

Even as the fintech sector sees growth, there are ongoing pervasive changes in the financial sector that cannot be ignored. Chief among the challenges are those posed by the increasing adoption of Generative AI (Gen AI).

Gen AI can offer productivity gains to banks, for example in terms of providing information to agents who assist in customer calls and manage customers. But there are risks arising from how data is collected and analysed.

At this current stage, Chia says: “The focus has been on building up the capability, both in industry and by the regulator, in terms of understanding the risk, and therefore how best to manage the risk.”

As an industry consortium, Project MindForge worked on identifying the risk of Gen AI, to ensure that all players reach a common level of understanding of the risk. The next step which is ongoing is to work on an AI Governance Handbook.

Chia explains: “The idea is that we do not rush into regulation first, as long as we assess that the financial institutions are approaching this responsibly and in a paced way.

“As validation is more difficult for Gen AI than for traditional AI, we will need to put in guardrails. But we see there is time for us to develop that understanding of the risk together with the industry. ”

Chia says: “Innovation brings productivity gains, but we are mindful of balancing the pace of innovation against the potential risks as we develop our understanding.”

Digitalisation – reliability and resilience

A second key theme for MAS is that of digitalisation.

Transforming and digitalising the financial sector is an ongoing process. At this stage, “the focus for MAS is on ensuring the reliability, resilience of that digitalisation”, says Chia.

The three local banks in Singapore have experienced various disruption incidents. After a series of incidents by DBS, the MAS imposed a six-month restriction, from Nov 1, 2023, to Apr 30, 2024, on the bank’s non-essential activities aimed at improving the resilience of its digital services.

Under the MAS’ technology resilience programme, various tech guidelines have been put in place to enhance the reliability and resilience of financial institutions’ critical systems, focusing on the adequacy of IT disaster recovery plan, the effectiveness of the IT disaster recovery test, and board-level involvement in overseeing IT disaster recovery preparedness.

In September 2024, MAS set up the Cyber and Technology Resilience Experts Panel which has an expanded mandate to cover technology resilience which, together with cybersecurity, significantly underpins the operational resilience of the financial sector.

The panel will recommend strategies and measures to enhance the technology and cyber resilience of Singapore’s financial sector.

What has emerged from the recent episodes and disruption, Chia says, is that it is essential to have enhanced testing, to boost the confidence in the recovery process. In other words, “one of the key lessons is that we need to have many fire drills.”

“Other lessons include avoiding having single points of failure, and to try to have backups and differentiate your channels so that it doesn’t all converge into a single point of dependency. The financial institutions will need to relook and review their architecture for such resilience.”

Sustainability

Sustainability continues to be an important theme for the financial sector. Singapore is Asean’s largest market for green, social, sustainability and sustainability-linked bonds and loans, and one of the most important green finance centres in Asia, with the country’s public sector planning to issue up to S$35 billion of green bonds by 2030.

Working with the industry and the Institute of Banking and Finance, there has been a significant amount of effort to upskill financial sector professionals to enable them to have the relevant knowledge.

MAS continues to focus on supporting infrastructural needs to facilitate industry development. One area would be relating to environmental, social and governance (ESG) guidelines which have been issued to enhance the credibility of retail funds selling their products as ESG-compliant.

Looking ahead

As a regulator, Chia’s view is that “we aim to provide a conducive environment, a facilitative environment, which means well-regulated, well-managed, but also one that facilitates innovation and enterprise”.

He agrees that different financial centres have different needs and serve different markets.

“For Singapore, our focus is more South-east Asia, and, to some extent, South Asia. We are confident we can identify the latest developments and areas that financial institutions want to develop. Together with Singapore’s general pro-business and pro-enterprise environment, stability, rule of law, and skilled manpower, Singapore is in a strong position.”