‘Tis the season. The weather gets cooler, kids go back to school, and many technology companies raise their dividends for the year ahead.

While artificial intelligence (AI) technology stocks aren’t necessarily known for high dividend payouts, they are known for growth. So if you can find a winning AI name that also pays a dividend, a small payout today could look much, much bigger in five, 10, or 20 or more years.

Two weeks ago, one semiconductor manufacturing company raised its dividend by 15%. But not to be outdone, one of its peers bested it last Tuesday — by raising its quarterly payout by 17%.

And yet, there are reasons I’m more bullish on the first company, if I had to pick between them.

KLA Corporation delivers an early Christmas

KLA Corporation (NASDAQ: KLAC), which makes semiconductor capital (semicap) equipment, announced Tuesday that it would raise its quarterly payout to shareholders by 17%, from $1.45 per share to $1.70, good for an annual dividend of $6.80. That’s an impressive increase, especially since it marks KLA’s 15th consecutive year of annual dividend increases.

The new heightened dividend only yields about 0.9% at the current stock price. But that shouldn’t necessarily stop dividend investors from looking at KLA. If a company has the ability to outpace inflation with dividend raises for years, it can make for a great long-term holding and wind up paying you a lot in retirement.

KLA’s outsized payout increase is a sign of optimism about AI growth, which should be celebrated. But two of its peers also just raised their dividends, and appear to have greater capacity to raise theirs even more in the years ahead.

How KLA is different from Lam and Applied Materials

KLA Corporation is a leader in process control and metrology equipment, which is used to inspect chips and wafers for defects at many points along the semiconductor manufacturing process. These machines are in high demand as chip designs get ever smaller and more complex, especially in the age of AI. Like many large semiconductor equipment names, KLA dominates its respective niche, with well over 50% market share for certain processes.

KLA’s dominant position, and the stability of process control and diagnostics relative to other equipment segments, get its stock a more favorable valuation in terms of a higher multiple. The companies that dominate the etch and deposition market, Lam Research (NASDAQ: LRCX) and Applied Materials (NASDAQ: AMAT), tend to trade at lower multiples, even though all three companies have similar long-term growth prospects, profitability, and cyclicality. Lam just raised its dividend by 15% two weeks ago. Applied Materials seems set for a big increase when it raises its dividend (as is typical) in March; six months ago, Applied raised its dividend by 23%.

Which semicap dividends seem primed for the most growth?

To be sure, KLA has proven itself to be a great dividend grower, and should continue to be. But despite its outsized raise today, it may be a little more constrained in how much it can grow its payout, compared to Lam Research or Applied Materials.

This is due to a variety of factors, including overall valuation, current payout ratio (the portion of earnings paid out as dividends), and leverage on the balance sheet:

|

Company |

Dividend Yield (Forward) |

P/E Ratio (Forward) |

Payout Ratio (Forward) |

Operating Margin |

Net Debt |

|---|---|---|---|---|---|

|

KLA Corporation (NASDAQ: KLAC) |

0.9% |

25.6 |

22.8% |

38% |

$2.13 billion |

|

Lam Research (NASDAQ: LRCX) |

1.2% |

21.1 |

25.6% |

29.2% |

($0.89 billion) |

|

Applied Materials (NASDAQ: AMAT) |

0.9% |

18.7 |

20.7% |

28.6% |

($2.85 billion) |

Data source: Yahoo! Finance. Forward payout ratio = forward dividend divided by current-year earnings estimates.

Now, all three of these look like great companies to own for dividend growth investors, with high margins and relatively low payout ratios.

But KLA does trade at a higher valuation, although it has more than $2 billion in net debt, while both Lam Research and Applied Materials have hefty net cash positions (more cash than debt). It also has a high trailing price-to-earnings (P/E) ratio at 36, much higher than its two peers, and a higher current payout ratio than Lam. So the forward estimates above already assume a lot of growth for KLA’s earnings.

Clearly, KLA’s dominance of its niche, evidenced by its higher operating margin, is tantalizing for investors. But by the same token, KLA is given credit for that with its higher valuation.

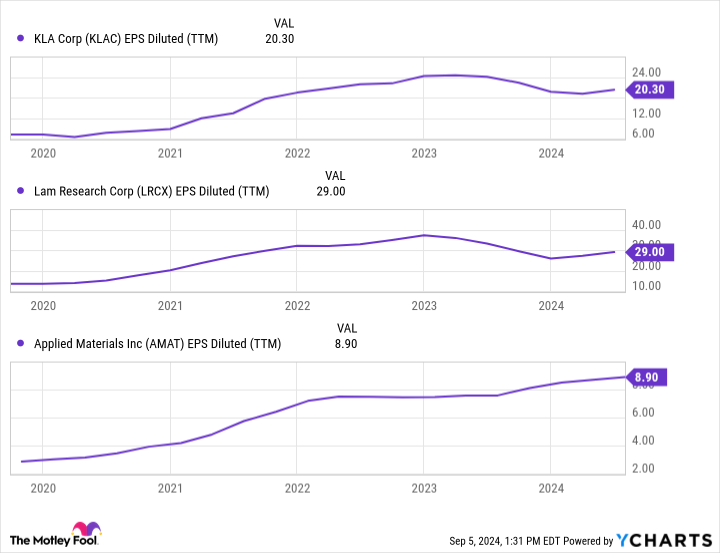

Meanwhile, its earnings power has shown itself to be similar, in terms of growth and cyclicality, to that of the other two companies:

Finally, while KLA has a dominant position now, it’s beginning to see some strong competition in the metrology market from both Applied Materials and newcomer Onto Innovation. So while it has higher margins and seems safer at the moment, there probably isn’t as much room for market-share or margin increases. Investors are simply assuming that both will continue to rise.

KLA is still a great stock, it’s just not preferable to the other two

KLA’s big dividend increase is another indicator of the bright long-term future of semicap equipment stocks, especially in the age of AI. No doubt it would be a great stock to own for the long term, and should continue growing its payout above the rate of inflation.

However, given their lower valuations, better balance sheets, and similar growth prospects, Lam or Applied would be my current preferences for future dividend growth.

Should you invest $1,000 in KLA right now?

Before you buy stock in KLA, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and KLA wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Billy Duberstein and/or his clients have positions in Applied Materials, KLA, Lam Research, and Onto Innovation. The Motley Fool has positions in and recommends Applied Materials and Lam Research. The Motley Fool has a disclosure policy.

Another Artificial Intelligence (AI) Stock Just Hiked Its Dividend, This Time by a Whopping 17% was originally published by The Motley Fool