Through the first eight months of 2023, Texans received nearly 270,000 student loan-related robocalls, robocall data expert Jim Tyrrell says.

Americans nationwide received an excess of 5 million of these types of robocalls during the same period, said Tyrell, vice president of Transaction Network Services, which analyzes over 1.3 billion daily call events across hundreds of carrier networks to identify current robocall trends and scams. Student loan scams target individuals and families with outstanding student loans or who are seeking financial assistance for education. These scams can take various forms and are designed to exploit vulnerable individuals by asking victims for upfront fees, faking loan forgiveness or through phishing scams.

Student loan robocall scams have surged over the past two weeks because Americans are dealing with several major developments at the same time. First, interest on student loans started accruing again on Sept. 1 for the first time since the onset of the pandemic. In October, students must start making federal student loan payments for the first time since the pandemic began.

Meanwhile, more than 4 million people have already enrolled in President Joe Biden’s new student loan repayment plan, SAVE and Republicans in Congress introduced a bill to block the SAVE plan.

“Students and families are trying to digest all of these confusing and at times seemingly contradictory developments on who must pay the loans and when — which is music to the ears of scammers who will exploit this chaos, confusion and fear through robocalls and robotexts,” Tyrrell says.

The start of the school year coincided with the spike in robocalls. Americans received nearly as many student loan robocalls, 350,000, in the first two weeks that school started as they did in the prior three months combined.

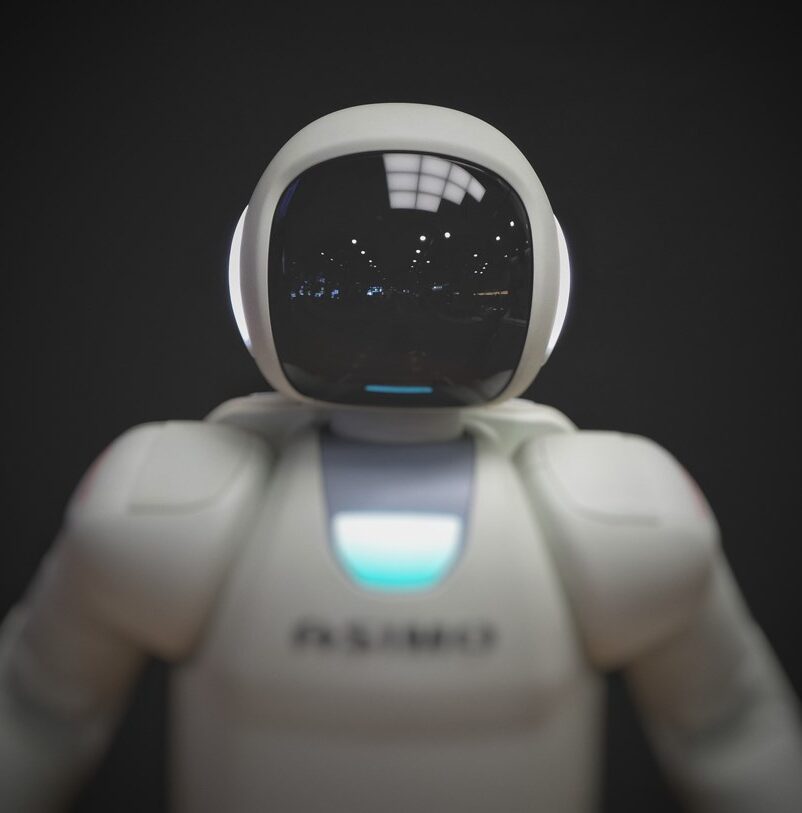

Scammers turning to inexpensive AI-generated deep fake robocalls

Scammers are turning to inexpensive, readily available AI voice cloning technology that can mimic the voice of a loved one to scam them out of money, Tyrrell said. These AI-generated deep fake robocalls make it very difficult for Americans to tell the difference between a real person at the other end of the line and artificial intelligence. Scammers also use call spoofing, which manipulates caller ID information to make it appear as though the call is coming from a legitimate source.

The sentence structure in these scams is sometimes choppy, which is one of the biggest giveaway that they are scams. Callers may also be aggressive in tone in demanding payment.

A few transcripts of these calls are below, per Transaction Network Services:

-

This message is for Dominic. My name is Rex calling from trying to reach you regarding a student loan, we may be able to lower or temporarily postpone your monthly payment. Please return our call. We’re open Monday to Friday from 8 a.m. to 9 p.m. Eastern Standard Time.

-

Thank you so much calling from Navy into assistance for students loan. So, Renee, it is important that we speak with you. We’re open Monday to Friday from 8 a.m. up until 9 p.m. Eastern Standard time. So please call us back.

-

Hey, this is James. I’m calling you from students. As you said, this call is about your student loan, which is now qualified for the forgiveness by the department education. And you have to pay back right? Hello.

-

Hi. May I speak with Ronald? Hello. Right now. This is man from student services. I’m calling about your federal student loan that is now showing possibly qualified for the loan forgiveness program. And this is through the Department of Education, so this program is government funded.

How can Texans protect themselves from robocall scams?

-

Resist the urge to engage. Student loan scams have been around for a long time, but fraudsters have continued to tweak their techniques to become more topical and realistic. Some scammers use Interactive Voice Response systems to find people who will answer the call and interact with them. If the potential victim responds yes, they will likely receive a text with a link, or be transferred to a live agent who may try to obtain their credit card and other personal information they might use to submit on your behalf. So step one is avoiding interaction with these calls — you can always follow up directly with your provider to be sure the call wasn’t legitimate. Don’t answer calls from numbers you don’t recognize; legitimate callers will leave a voicemail.

-

Stay attuned to when scammers strike. Operate under the assumption that when something sounds too good to be true, it is. Always be vigilant, especially so when the news cycle is active.

-

Educate yourself on the latest scams. The Federal Communications Commission and Federal Trade Commission keep you informed on recent scams, and TNS has a scam of the month resource page to help consumers stay aware of trending scams.

Call-blocking apps offered by leading telecom providers across the country are a great resource for reporting and blocking unwanted robocalls.

Americans received 77 billion robocalls over the past 12 months, which helps explain why 68% of people surveyed by TNS now refuse to answer calls from an unknown number. But because never answering the phone poses a challenge for callers seeking to reach individuals with important and time-sensitive information, carriers and providers are working on new technologies to address that. TNS is working with carriers and businesses to deploy branded calling technology, which displays critical brand information on incoming call screens to better educate consumers on who is calling.