It’s only halfway through 2024, and yet the capital markets are roaring like there’s no tomorrow. The Nasdaq Composite is up 19% so far this year, and reached an intraday high of 17,936 just days ago on June 20.

The Nasdaq is a tech-heavy index. Given the euphoria surrounding all things artificial intelligence (AI), tech stocks in particular have been major contributors to the Nasdaq’s red-hot start to the year.

However, not all AI opportunities have fared so well. Shares in electric vehicle (EV) company Tesla (NASDAQ: TSLA) are down about 20% in 2024. Although concerns about EV demand and competition in the sector linger, one investor in particular is undeterred.

Ark Invest Chief Executive Officer Cathie Wood recently released a revised price target for Tesla stock. Her base case model is forecasting a price of $2,600 per share in Tesla by 2029 — implying about 1,300% upside from current trading levels.

Let’s dive into Wood’s research and assess if Tesla stock is a good opportunity right now.

It’s all about Robotaxi

Right now, Tesla’s revenue largely stem from two sources: EVs and energy storage products. Over the years, Tesla CEO Elon Musk has revealed that his vision for Tesla includes products in robotics and artificial intelligence (AI), both of which will be used to complement the EV business.

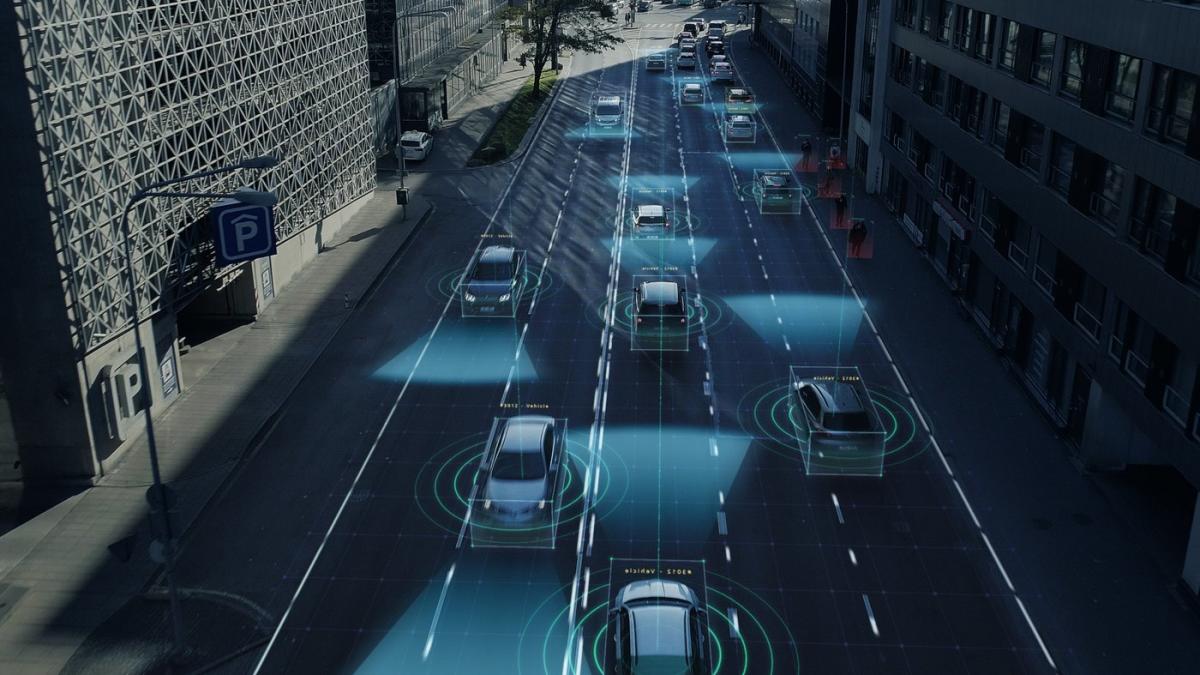

One of the biggest initiatives at Tesla right now is the company’s development of autonomous driving software. Dubbed full self-driving (FSD), Musk aims to integrate this technology across Tesla’s fleet of EVs. While this is exciting, it’s really only the first phase of Musk’s long-term vision.

The broader scope of FSD has become known as Robotaxi. Essentially, Musk wants to create a large-scale fleet of Tesla vehicles that are both fully capable of autonomous driving and constantly in motion at any given time.

Think of it this way: Instead of hailing a taxi in a city or going to rental car service at an airport, you could have the option to just order a Tesla Robotaxi right from your phone. The implications for such a service should not be underappreciated. The advent of a widespread Tesla fleet could completely disrupt ride-hailing platforms such as Uber and Lyft, as well as delivery and logistics services from DoorDash and even Amazon.

How would Robotaxi help Tesla’s overall business?

The crux of Wood’s bullish thesis hinges on a successful launch of Robotaxi. However, understanding the details around the economics of Robotaxi sheds light into why the tech investor is calling for a more than 10-fold increase in Tesla stock.

While Robotaxi may seem like a mere extension of the core EV business, it’s actually quite different. When a consumer buys a Tesla, it’s highly likely that this is a one-time purchase, or at least one that won’t be repeated for a number of years. By contrast, consumers could use Robotaxi services an infinite number of times.

In essence, Robotaxi will carry much higher gross margins than Tesla’s EV operation. Wood describes the margin profile on Robotaxi as akin to a software company, which her research suggests sits at about 80% on average. When compared to the average margin of about 16% for auto makers, it’s understandable why Musk is relentlessly focused on launching Robotaxi.

The compound effect of a high-margin Robotaxi fleet is that this operation could spur a surge in cash flow, which Tesla can then use to reinvest into other projects and further differentiate from the competition.

Is Tesla stock a good buy right now?

I think investors may have soured too much on Tesla, as reflected by the share price decline. Although growth in the EV business is slowing, it’s important to remember that the macroeconomy also poses its share of challenges, from lingering inflation to high interest rates. Both of these factors can affect a business in any industry, especially automobiles.

Right now, much of the chatter around Robotaxi is reserved for speculation from Wall Street pundits. However, Tesla is set to make a major announcement on Aug. 8 about Robotaxi.

I see this as a good opportunity for investors to dial in and get a glimpse into Musk’s roadmap. I think a prudent strategy for investors is to monitor Tesla’s progress as it relates to FSD, EV demand, and the rollout of Robotaxi.

Should you invest $1,000 in Tesla right now?

Before you buy stock in Tesla, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tesla wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $772,627!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon and Tesla. The Motley Fool has positions in and recommends Amazon, DoorDash, Tesla, and Uber Technologies. The Motley Fool has a disclosure policy.

The Nasdaq Just Notched Another All-Time High, and Cathie Wood Thinks This Artificial Intelligence (AI) Stock Could Soar Another 1,300% was originally published by The Motley Fool